Introduction: A Spotlight on Bali

In recent months, Bali has received increased global attention, particularly regarding expats—both tourists and investors. While a few incidents involving tourists have gone viral, this does not necessarily indicate a rise in actual cases.

Rather, social media and online algorithms amplify these events, often for personal or political gain. Regardless of intent, such coverage can harm Bali’s image and its crucial tourism sector. This calls for proactive public relations from both policymakers and industry stakeholders.

Investment Challenges: Abuse and Misunderstanding

On the investment side, we have seen several cases of foreign investors misusing PMA structures or taking advantage of locals. While many investors genuinely aim to contribute to Bali’s economy, problems arise from poor guidance and lack of awareness.

A major issue is that many agents and consultants do not properly inform clients about how to legally maintain their PMA structures. Similarly, many expats take the process for granted, unaware of Indonesia’s strict compliance requirements. As in any country, ignorance of the law is not a valid defense.

To stay compliant, a PMA must:

- Report corporate and VAT taxes monthly

- Report dividends properly

- Submit quarterly LKPM reports to the Ministry of Investment

- Ensure that visa types match actual activities declared in the PMA

Government agencies are now coordinating more closely. For example, BKPM has recently shared lists of inactive companies with Immigration, which in turn has flagged visa violations.

Many illegitimate PMAs are being scrutinized, and companies operating outside their declared KBLI business activities face similar consequences. With the core tax system being implemented, compliance will only become more data-driven and rigorous.

Construction and Permit Violations

Since COVID, Bali has seen rapid growth in construction—much of it unregulated. Some developments lack basic permits (PBG), and violate rules on building height, exterior design, and zoning. These issues stem partly from overwhelmed government agencies, but that does not excuse noncompliance.

Building without permits is illegal and risky:

- No insurance coverage is possible

- Accidents during construction can lead to severe liability

- Buyers rarely ask about permits, exposing themselves to future legal and financial issues

The time to obtain a PBG is reasonable by international standards—4 to 8 months depending on the regency. Village heads should be empowered to enforce permits on a door-to-door basis. Projects without permits should be immediately referred to SATPOL PP, PUPR, or even police for enforcement.

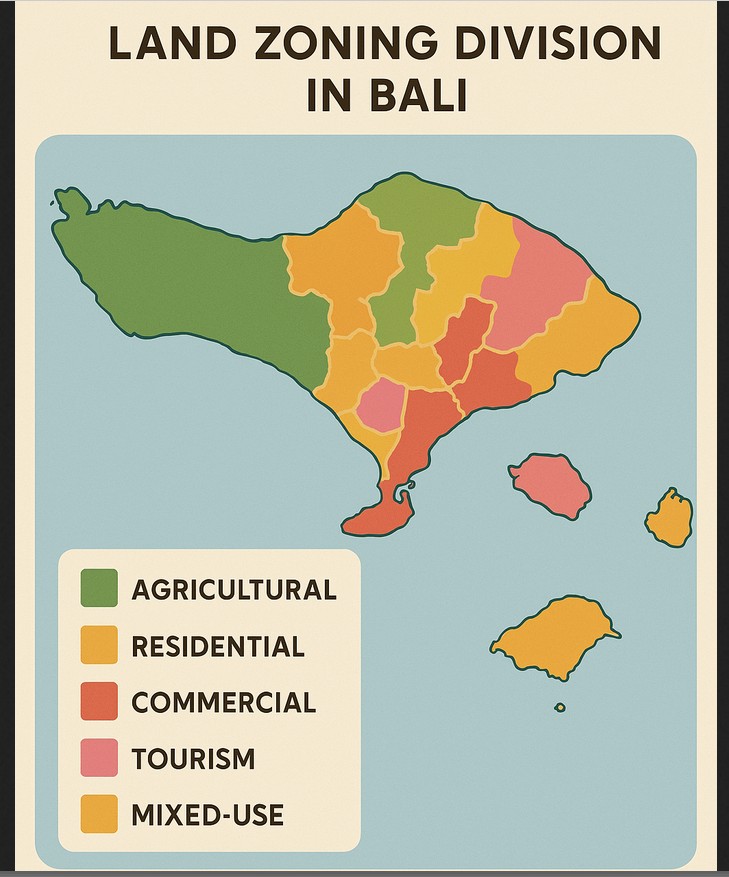

Zoning violations are also rampant. Many investors and even consultants are unaware that PMAs can only operate in designated tourism and mixed-use zones. The government should enforce existing sanctions against noncompliant developers, civil servants, architects, and contractors.

The SLF and Zoning Loopholes

The SLF (Sertifikat Laik Fungsi) certifies that a building complies with technical and design standards. Many developers delay or avoid the SLF due to processing times (up to 4-6 months), but operating without it is a major risk.

Recent cases show SLF applications being rejected, especially for HGB properties held by PMAs in yellow zones. Some work around this by using leasehold structures with local owners, but this may eventually be seen as regulatory circumvention.

The Lease Misconception

There is a common misconception that any foreigner can hold a long-term lease in Indonesia, including for commercial use. This is incorrect.

- Only a PMA or a KITAS-holding expat can legally hold a long-term lease for business purposes

- Private leases by non-residents should be for residential use only

A simple and effective solution would be to require lease registration (Hak Sewa) at the BPN, stamped onto the freehold certificate. This would:

- Prevent landlords from taking additional loans against leased land

- Ensure lease agreements comply with zoning rules

- Confirm lessees are eligible under immigration and corporate law

Tax Evasion and Underreporting

Leases are taxed heavily, perhaps too heavily, which may be why many sellers underreport transaction values—sometimes by more than 50%. While this benefits sellers in the short term, it hurts both the government and buyers:

- The government loses out on VAT, final PPh, and corporate income tax

- Buyers lose depreciation value, increasing their eventual tax burden

To resolve this, the government should set minimum declared property values by area, much like NJOP values for freehold land.

Architects and Construction Oversight

Architects should be licensed and accountable for ensuring compliance with Bali’s building codes. Sanctions should be enforced for noncompliant designs, either on the architect or the developer.

Adding a certified, independent construction management layer would further ensure quality and cost control. In most cases, this would also help developers avoid costly mistakes.

Conclusion: A Path Forward

The path to sustainable development and investment in Bali requires:

- Investor education

- Stricter permit enforcement

- Transparent leasing structures

- Coordinated oversight among government bodies

For investors, the message is simple: do it right. For the government, it’s time to enforce existing rules. Bali’s future depends on it.