The Jakarta E-TRAPT Tax System is a newly launched online tax reporting platform designed to modernize tax administration in Jakarta. Developed by the Jakarta Regional Revenue Agency (Bapenda DKI Jakarta), this system streamlines tax reporting by automating transaction data collection. With this new system, the government aims to enhance transparency, improve tax compliance, and reduce administrative burdens for taxpayers.

What is the Jakarta E-TRAPT Tax System?

E-TRAPT, short for Electronic Transaction Perporation Agent, is an advanced system that collects transaction data from various sources. It consolidates this information efficiently, ensuring accurate and timely tax reporting. Specifically, the system captures transaction details and sends them directly to Bapenda’s servers for automated tax calculations.

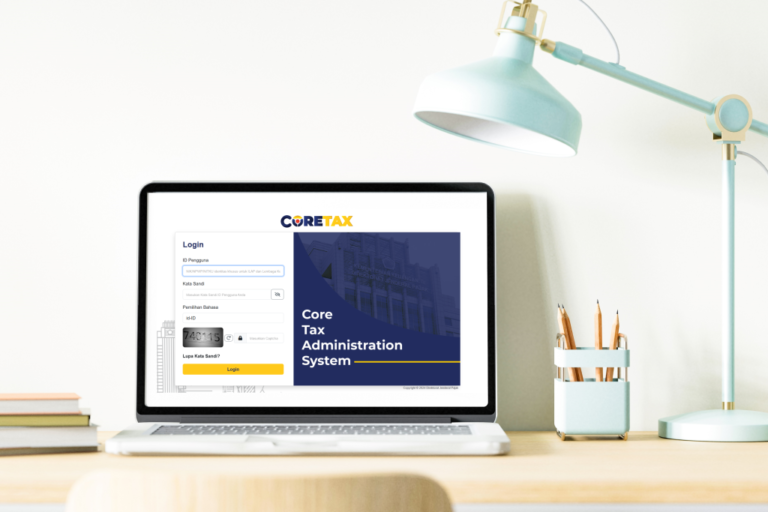

Previously, Indonesia’s Coretax system experienced delays and inefficiencies in processing tax reports. As a result, the government introduced E-TRAPT as a more reliable alternative for the people of Jakarta. According to Lusiana Herawati, Head of Bapenda DKI Jakarta, “Taxpayers are expected to transition to this system so that tax administration can be optimally structured. The government continues to promote and facilitate the transition to ensure that all parties benefit from the new system.” She said, as reported by Bisnis.com.

Key Features of E-TRAPT for Taxpayers

- The E-TRAPT system introduces several features that simplify tax filing. Some of the most notable include:

- Automated transaction recording – Taxpayers no longer need to manually submit transaction details.

- Tax calculation assistance – The system suggests the payable tax amount based on recorded transactions.

- Seamless integration – E-TRAPT connects with multiple transaction sources, significantly improving data accuracy.

- Simplified reporting – Taxpayers can submit reports by simply filling out the Local Tax Notification Letter (SPTPD).

Herawati emphasized the system’s efficiency, stating, “By simply completing the Local Tax Notification Letter, reports can be submitted quickly and easily.”

How to Transition to the E-TRAPT System

Businesses and taxpayers in Jakarta must transition to E-TRAPT to comply with the city’s electronic tax reporting regulations. Fortunately, the installation process is managed by Bapenda teams, who directly set up the system for registered taxpayers.

For businesses that have not yet adopted online transaction reporting, Bapenda’s implementation team, under the recommendation of the local Tax Service Unit (UPPPD) and Sub-Agency, will install the system. However, taxpayers may also request installation independently by submitting an application to UPPPD or Bapenda DKI Jakarta.

Benefits of E-TRAPT for Businesses & Jakarta’s Economy

The Jakarta government aims to increase efficiency and compliance through E-TRAPT. This system offers several advantages, such as:

- Greater transparency – Automated transaction reporting reduces errors and ensures accountability.

- Faster tax processing – Digital tax submissions eliminate manual delays, making the process much more efficient.

- Business-friendly approach – E-TRAPT reduces administrative burdens, allowing businesses to focus on growth rather than paperwork.

- Incentives for compliance – To further encourage adoption, the Jakarta government provides special incentives for taxpayers who implement E-TRAPT early.

Herawati highlighted the system’s benefits, adding, “The goal is to assist taxpayers in reporting and fulfilling their tax obligations easily, as E-TRAPT is a software agent, not a tapping box device.”

A Step Toward Digital Tax Modernization

The Jakarta E-TRAPT Tax System represents a significant step toward digital tax modernization. By making tax reporting more transparent, efficient, and automated, the system simplifies compliance for businesses and individuals alike.

Moreover, with incentives for early adopters and a streamlined reporting process, Jakarta is pushing for a more effective tax administration system. “The implementation of E-TRAPT is a major step in modernizing Jakarta’s tax system. With this system, tax reporting becomes more transparent, accurate, and efficient,” Herawati concluded.

Source: ekonomi.bisnis.com

Image: Getty Images